Payroll

Administering payroll can be a daunting and time consuming task. It is made all the more difficult by the growing complexity of taxation and employment legislation and the accompanying regime of penalties for non-compliance.

Why not let us take care of your payroll bureau so that you can concentrate on growing and developing your business? Whether you have only one employee or a hundred we can tailor our payroll services to suit your needs and provide you with support when required.

Our comprehensive and confidential payroll services include:

- Payroll run on quarterly, monthly, fortnightly or weekly basis

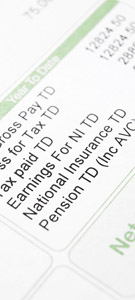

- Customised payslips

- Administration of PAYE, national insurance, statutory sick pay, statutory maternity and paternity pay, incentives, bonuses, student loans, etc

- Summaries and analyses of staff costs

- Joiners, leavers, changes of PAYE codes

- Completion and submission of statutory forms, including yearend returns to HM Revenue & Customs and your employees such as P35, P14, P60

- Childcare vouchers

We will not only provide you with the payroll documents but also keep an eye on any submission deadlines and advise you when and how much income tax and national insurance to pay to the Inland Revenue.